Moral Arbitrage: The British Financialization of American Slavery 1820s - 1880s

My second book project, provisionally entitled, Moral Arbitrage: The British Financialization of American Slavery, turns from an internal history of the British financial system to the broader social transformations and human consequences that the rise of modern finance wrought on the wider world.

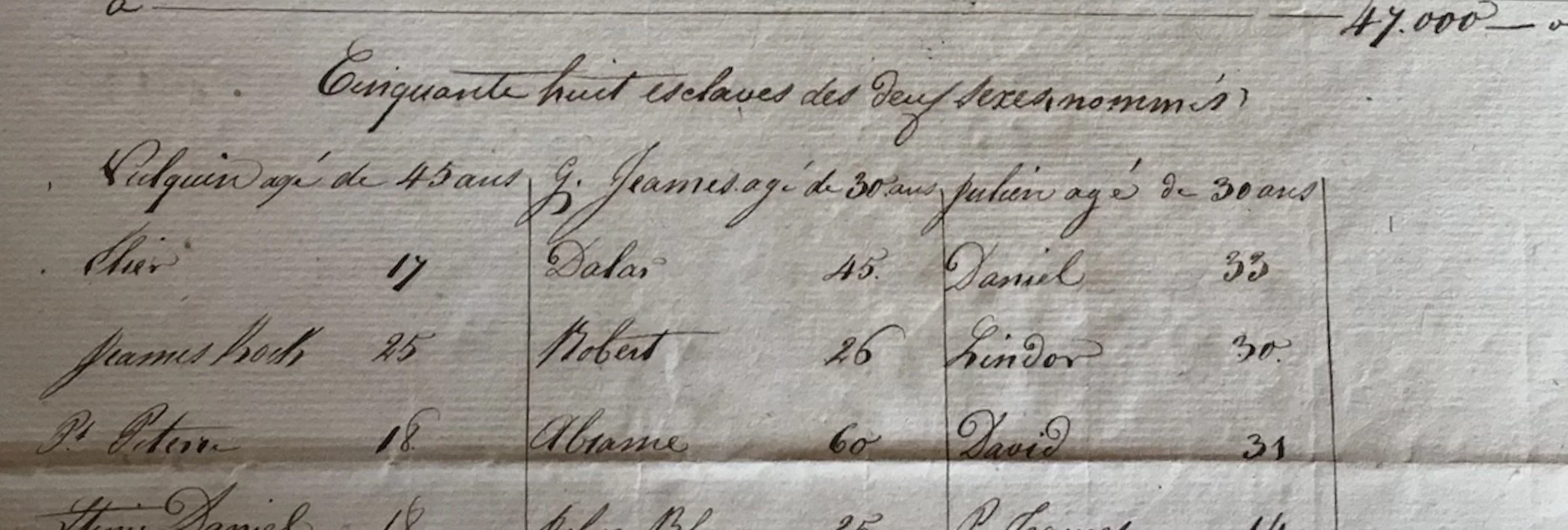

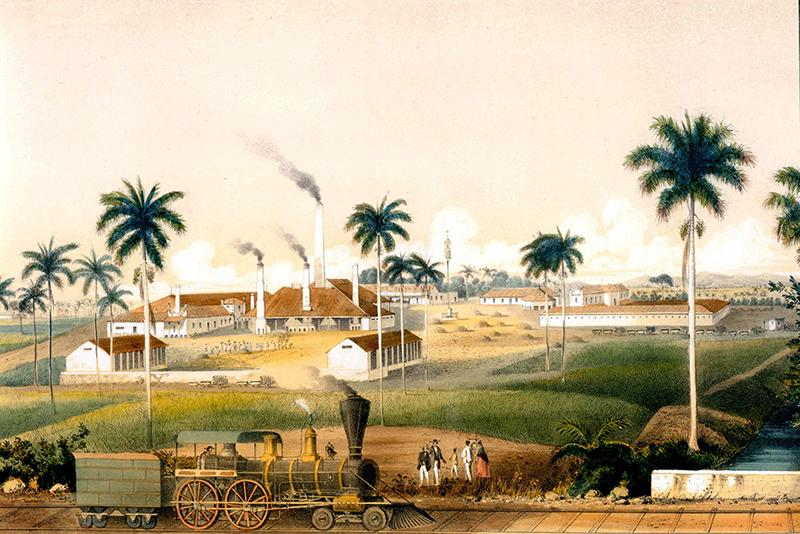

In the 1830s, at the same moment that slavery was abolished throughout the British Empire, Britons became slaveowners again in new ways. Rather than buying and selling enslaved people in West African ports or on colonial auction blocks, Britons began buying and selling them through financial instruments traded on the London Stock Exchange. Moral Arbitrage argues that the abolition of slavery within the British Empire created a massive market opportunity for investing in slavery beyond the empire’s boundaries, an opportunity that British financiers pursued aggressively throughout the 19th century. In other words: the codification of liberal, anti-slavery laws within the British Empire presented actors who were willing to avoid, subvert, and challenge those laws with profitable, if morally odious, investment opportunities throughout the rest of the world. As British capital poured into the slave societies of the U.S. South, Cuba, and Brazil, British slave-ownership morphed into more abstract financial forms, creating a financialized property in people that lasted well into the age of abolition.

The research for this book has been supported by grants and fellowships from the Mellon Foundation, the National Endowment for the Humanities, and the Business History Conference among others.